Credit Where Credit is Due

A Summary of the Collaborative Finance (CoFi) Commons Gathering

On May 20, Matthew Slater convened the Collaborative Finance or CoFi gathering, focusing on credit theories of money. People from all over the world gathered in the mountains of Austria at the Commons Hub, hosted by the crypto-commons association, to meet, share, exchange, enjoy and think-feel collectively about how to change money & credit. Some of the most inspiring people & alternative money projects alive today were present: Grassroots Economics, the Hudson Valley Current, Sardex, MYCHIPs, Sikoba, Ledger Loops, Resource Network and many more. When we were not talking about money, we heard a very powerful conversation about how communal democratic self-government works in practice in Rojava (Autonomous Administration of North and East Syria) and in the 48 cantons of Totonicapan in Iximuleu (Guatemala) by the powerful Lucia Ixchiu.

The days were organised based on different credit structures or credit systems that are used today to settle debts between people in a peer to peer and collaborative fashion: mutual credit, multilateral trade credit set off, mesh credit systems, money voucher systems and more.

Towards Integrations: Circles UBI Mesh Credit and Informal Systems' Multilateral Trade-Credit Set-Off (MTCS)

What follows is an incomplete synthesis from my own perspective, and an attempt at a summary based on a group exercise I was part of, organised by Dil Green from Mutual Credit Services on the last day of CoFi. We were asked to think how we could collaborate concretely with the systems present in our groups, and in the process of integrating our systems bring a new financial system into being.

For me, it began when members of the Collaborative Finance team at Informal Systems and members of the Circles Coop and bitspossessed developer collective met to discuss how to integrate the CirclesUBI mesh network to the Multilateral Trade-Credit Set-off, or MTCS being developed by the CoFi Informal Systems team, and to do so in a way that is privacy-preserving by design.

This means creating an integrated system architecture where credit relationships are hidden and there is no global view of the payment or trust graphs. Both Informal and Circles teams were surprised to discover we both had independently ended up asking similar questions and looking for answers in oddly the same places.

One example is Taiga, a framework for generalized shielded state transitions being actively developed by Anoma. Taiga is based on what I would describe as a post-smart contract logic that separates computation from verification, based on the matching of what they call intents and validity predicates. Serendipity is a real thing. A member of the Anoma team joined us for CoFi and was kind enough to explain what bizarre-sounding things like fractal instances mean while going on hikes and spontaneously during a credit and anonymity afternoon session. Both teams realised we were sitting on the mountainous shoulders of giants and giants, as my friend and network scientist Teodoro Criscione told me days later, move slowly.

CirclesUBI is mesh credit network designed to deploy a non-state basic income system. Circles has been in production since October 2020. Ideated by Martin Köppelmann, founder of Gnosis, and brought into being by what became the Circles Coop and the Bitspossessed collective, the CirclesUBI protocol works in a way where people are the ones claiming the power to issue credit and make payments in a rippling network of trust, effectively giving each other a basic income. The Circles Coop is running a pilot in Berlin with roughly over 2000 people and 20+ businesses that participate in a subsidy program where strategic businesses get cash for a % of their Circles sales in Euros. The issuance of a people powered basic income serves as the basis for internal liquidity and a primary market for the businesses in the pilot.

Now, one of the problems we currently face as a Coop is that the Euros we get come largely from donations and this is not sustainable. While we have been able to do what economists call infant industry protection at a small scale, we have not yet secured a sustainable source of investment for bringing local production to the next level. At least not yet. Here’s where things get really interesting.

In the early 1990s, as Yugoslavia was being ripped apart by neoliberal policies, one thing made all the difference in the realm of money: a public credit clearing system. During state communism, Yugoslavia’s payment system was a public good and not a weapon that is used today by private banks to make a profit. This system is still alive today in Slovenia. Businesses can input the receipts at the end of the month to what is known as a multilateral trade-credit set-off. The clearing works in a way where if businesses have outstanding debts with other businesses, they can be cleared through an algorithm that checks who owes what to whom. The end result is that businesses end up with less debts to be paid. That is, if they have to pay anything at all. Often it is the case that all debts between merchants can be fully cleared, but not always.

This is also known as a Liquidity Saving Mechanism (LSM). According to the amazing Tomaž Fleischman, part of the Informal Systems team and co-author of the paper Liquidity-Saving through Obligation-Clearing and Mutual Credit: An Effective Monetary Innovation for SMEs in Times of Crisis, it is possible to create a network of obligations using this method, clearing off debt and thereby saving about 25% of the liquidity in any country’s economy (without mesh or mutual credit). Informal Systems has now further developed this as an algorithm that can run millions if not hundreds of millions of settlements.

What came out of the initial meeting between Informal Systems and the Circles team is that by integrating both systems businesses in the Circles network could use the MTCS algorithm developed by Informal to clear debts with each other and any outstanding debt that businesses may have.

What brings things full circle is that loans to productive investment in small and medium enterprises (SMEs) & the cooperative sector within the pilot could also be run through the MTCS algorithm. If we were to allow not just internal but external liquidity in the form of business zero or low interest loans, strategic businesses could use the extra liquidity to buy the supplies they need from others, thereby creating economic linkages and larger Business to Business (B2B) trade. As more and more business trade is denominated in Circles, businesses can reduce their costs while increasing their overall sales. These flows can be used in part to pay back the loans. Before using external liquidity (loans) to help MTCS, we can rely on the internal liquidity of the Circles p2p mesh balances, later via businesses' fiat bank balances if they co-pay with fiat money. In this way, the profits generated from the business network can be distributed as shared equity back to the people receiving their UBI and, importantly, to fund new community industry protection. The result is distributed credit and distributed equity. What’s not to like?

We had gotten this far by Thursday, which is rare for conferences in this day and age. In the group exercise on Saturday, we had representatives from CirclesUBI, Informal Systems/Cosmos, Holochain and an organisation called the Economic Space Agency (ECSA). We were tasked to think collectively and speculatively about how to create concrete collaboration with the other projects present: Holochain, Cosmos, and ECSA.

Holochain & Cosmos

Enter Holochain. Holochain is a distributed application platform that enables users to build and run p2p applications. Holochain’s architecture is unique in that it is agent-centric, meaning that each node in the network is responsible for its own data and processing. This allows for high scalability and eliminates the need for a central server or database. Additionally, Holochain is highly flexible, allowing developers to create custom applications and protocols tailored to their specific needs.

Paolo Dini from Informal suggested that we could make a Circles Holo App because of the similarities in both system architectures. Because Cosmos requires fast finality, there could be an Inter-Blockchain Communication (IBC) bridge between Cosmos and Holochain that runs the MTCS monthly or quarterly to manage the change of states. Here it is worthwhile to mention that Circles currently uses Gnosischain as a settlement layer. Using the Anoma intent centric framework, and with a few pasta curve updates on different EVMs, Circles can traverse and settle in many more blockchains who support our cause, like Celo and Evmos.

ECSA

According to their own website, ECSA is:

building a peer-to-peer economic networking protocol which is open and free to use and gives everyone equal capacities of ECONOMIC-ORGANIZATIONAL EXPRESSION…creating a LANGUAGE for new economic expression.

The provocation many of us posed throughout CoFi to the ECSA was: can you explain what you do in a simple manner?

ECSA is proposing in their new book a protocol they referred to as mutual staking to form an alliance of projects that have mutually aligned interests through what I understand as co-investments based on digital asset token sales. This rings similar to the crowd-staking app by Breadchain as proposed by The Blockchain Socialist. For now these proposals are still in the ideation phase, and we look forward to seeing them come to fruition one day.

CoFi Commons Framework

To recap, we have within reach an emergent convergence of different credit structures that together become more than their individual parts, running on distributed infrastructure:

- A mesh credit system as a UBI distribution mechanism and p2p payment system.

- Multilateral Trade-Credit Set-Off for SMEs and Coops in a trust network looking to save liquidity through the matching and clearing of trade obligations coming from internal & external liquidity provision.

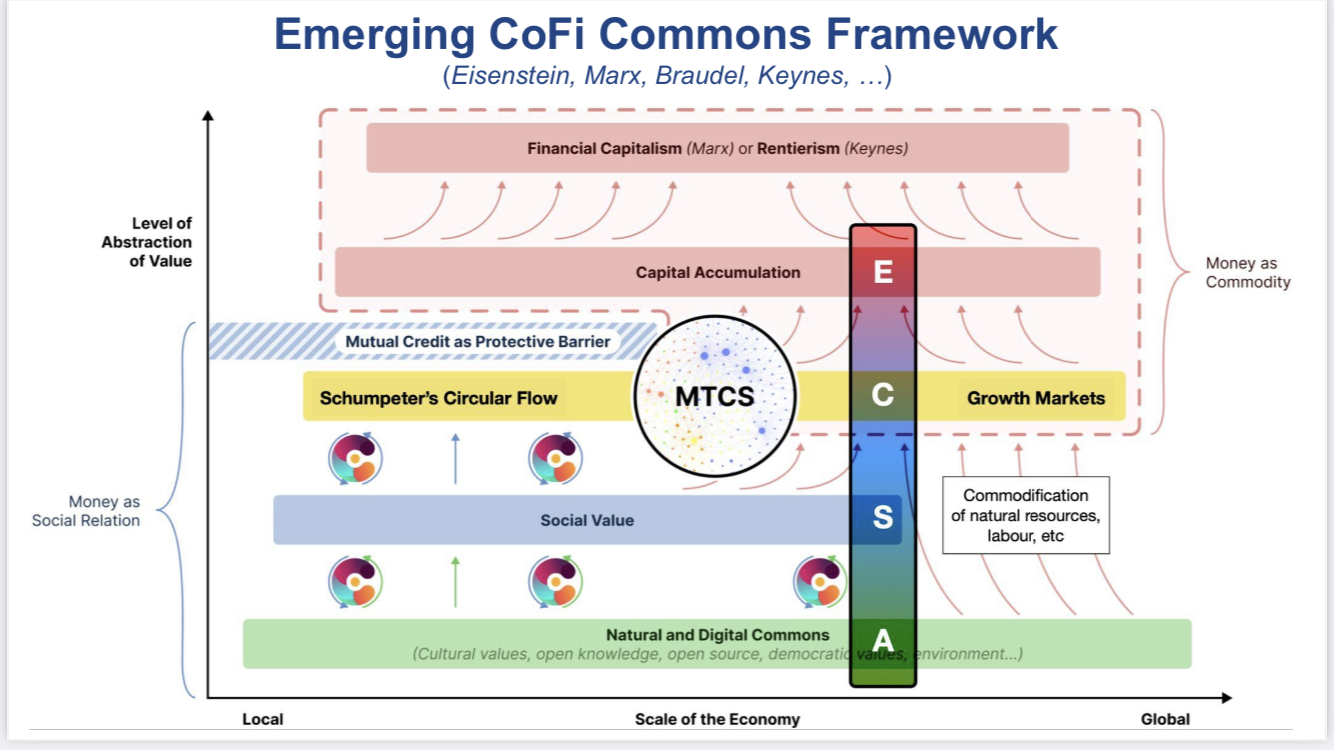

Illustration summary by Paolo Dini of the Emerging CoFi Commons Framework

Circles communities spread through trust relations, where a person only accepts credits from people they directly trust but can pay anyone in the network through transitive transactions. People in the UBI mesh can support trade credit networks through p2p liquidity provision. Therefore, communities are likely to benefit from MTCS even with smaller numbers.

In that sense, there could be some sort of Cosmos/Anoma chain for doing the credit offsets for businesses which could become a persistence layer for multiple Circles/Holochain communities at some point in the future. Holochain also has a gossip network which we could consider using to complement the privacy preserving version of Circles, powered by the Anoma framework. But this is still too early.

In any case, it would appear that we are witnessing the making of an alternative financial system, “CoFi Commons” or a money commons that centers the care of people and planet via basic income, one where economic and technical autonomy is built through (re)productive investment in translocal vital infrastructure and b2b trade. As one of our principles in Circles says: local solutions for global problems.

To conclude, it is important to say that for collaboration to take place with others who have vastly unequal power differentials, we should give credit where credit is due: to the people, communities, and teams that are building infrastructure and experimenting with economic alternatives on the ground. If we do not value these projects of action, we risk the invisibilization of the people doing the actual (care) work in bringing new systems into being.

We agreed the next steps are to continue discussing and building the missing pieces of the puzzle, expand the limits to our imagination and to do more pilot projects to prove that this is not only possible but absolutely necessary if we are serious about creating a plural monetary fabric where many worlds can live.

Julio Linares

co-founder - Circles Coop

Reichenau an der Rax - May 28, 2023

YOU MIGHT ALSO LIKE

Dsrrptv + Dscntrlzd ≠ Dscnnctd: A Review on Disruptive Technologies and Data Protection