Trust is Power.

We are constantly swimming in a sea of trust.

If you’re lucky enough to live in a place where you can open the tap and fresh clean water comes out, or when you access your comfortable internet connection, open your electricity-battery-charged laptop using that operating system in order to send messages in that encrypted chat to your friends, that is trust. When you wait for the streetlights to change color on your way to the train station or when you pay Amazon using your debit or credit card to organize the logistics that deliver commodities to your house, you are immersed in a sea of trust.

What do you think would happen if these systems collapsed? How would people react?

Some might say: “I never gave my trust to a lot of these systems”. And they are right. We are so used to using systems we did not consent to in the name of “convenience”, division of labor, expertise and such other complicated explanations. We may not like some of these systems, either because of what they stand for or how they are organised, but there they are. We decide to use them on an every day basis. By delegating our trust to these structures, we legitimize them and give them power over us. In that sense, trust is power. But how did we come to trust systems that have such a deep influence over our lives, without our consent?

This short essay is not a philosophical treatise on the multi-dimensional elements of trust, its complexities and contradictions in society. We leave that for another time.

What we would like to do in this little essay is simply to explore the tip of the iceberg. We would like to make the case for trust and why it matters when it comes to the curious case of the money system. We will do this through an exploration of the Circles UBI system.

To truly unleash the powers of a system like Circles, one must first understand what it is that we are holding. To do that, we need first to briefly talk about 2 things:

- What do we mean when we say that Trust is Power

- Why is trust needed in credit systems?

In Promises We Trust

Money, regardless of its forms and uses, is based on trust: it is an agreement between people, a relationship of debt. As a debt, we only believe in money because we trust in the promises we make with it. When you want to buy bread at the bakery close to your house, you trust that the bills you have in your wallet are redeemable for bread. The baker accepts your bills and can then pass them on to others in order to buy what she needs to make her bread and pay for her rent, mainly because she trusts that others will accept her money. People trust the promises of others to give them stuff for their money. But why?

Money is a specific type of promise as it has the power to claim resources from others, who accept and redeem those promises at some point in the future. In this sense, we should think of money and power not as separate entities. Instead, we should think of money as power. Because money is a balancing act, a bridge between the present and the future, one could argue that money is a projection that has the power to bring universes into being. In times when people gradually loose faith in what the future will be like, trust in the system begins to crumble.

The word for credibility and credit comes from the Latin credere or creditum, which meant to believe or to entrust somebody. This is not a coincidence. When you give somebody credit, you trust that they will pay back their debts to you at some point in the future. Money holds the promises of the types of futures we want to create with each other. It is a symbol of our collective imagination. In this sense, trust is power because it can turn the present moment into a common future.

Trust creates new worlds. Trust is what allows people to build long lasting relationships with each other. Trust in a person or a group creates a sense of belonging and it is a precondition to produce meaning on both an individual and collective level. Without trust, what’s the point?

Going back to our example of the baker, the reason why people trust her bills is not because of her nice croissants but because these bills were issued by something called the State. What we call cash are really the promises of the State. Cash comes from the word caisse in old French, which meant “money box”. We trust the promises of the State mainly because we all know we need it’s money box at some point in order to obtain the stuff we need, or because the State demands a tribute for the stuff we make. Whether we like or dislike the State, without it’s magical money box, we would not be able to claim the things that we need in order to live. We are all, in a way, locked-in. Our trust has been effectively enclosed within the imaginary of the State (1).

But what if this was not the case? What if people had the power to issue out their own promises and circulate them with those around them, claiming the resources they need in order to live, claiming their own futures? What would trust in a money system be like if it was not based on coercion but mutual aid?

Enter Circles UBI.

Circles is a people-powered money system that grants everybody who joins the unconditional power to issue promises. The Circles system is a monetary creation process that happens from the bottom-up; that is, it happens from the perspective of people, who go in and out of obligations with one another when they issue money outwards into the world. Circles is a social and technical infrastructure for the distribution of an Universal Basic Income (UBI). It is a way of expressing the mesh of interdependencies that human beings are embedded in all the time. Because Circles is people-powered and not based on a state or a bank that can loot you out of your possessions if you do not pay back your debts, trust has a more consensual meaning.

Trust has therefore a two-fold meaning in the Circles system.

Firstly, trust means that you acknowledge somebody is a real person: trust means that people are who they say they are. In the initial iteration of Circles, in order to enter the system you need 3 people to trust you. You might think this is an annoying technicality, but trust is there to avoid people making fake accounts, pretending to be someone who they are not and claiming, unfairly, 2 wallets for themselves. In Circles, people should have an equal power to issue money into the system.

The point of Circles is not to replace the trust between people with a faceless technology, but to create new social and political institutions with the infrastructure this technology provides by leveraging people’s trust. Building trust therefore means building power. From a socio-technical design point of view, trust in the Circles system is needed so that people can ensure others are who they say they are without the need for creepy state biometrics and surveillance capitalism dystopias. Only people can, in relating to others, trust other people. Trust is a relational process.

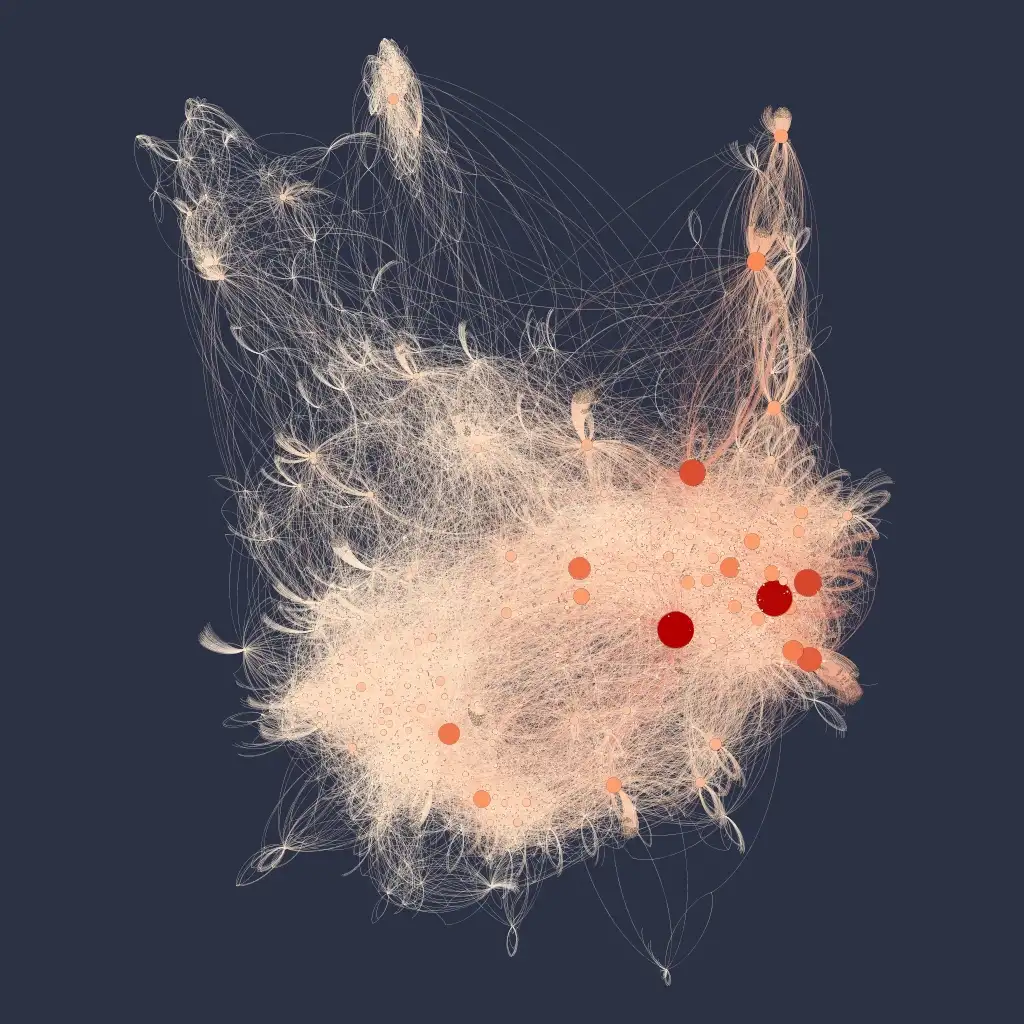

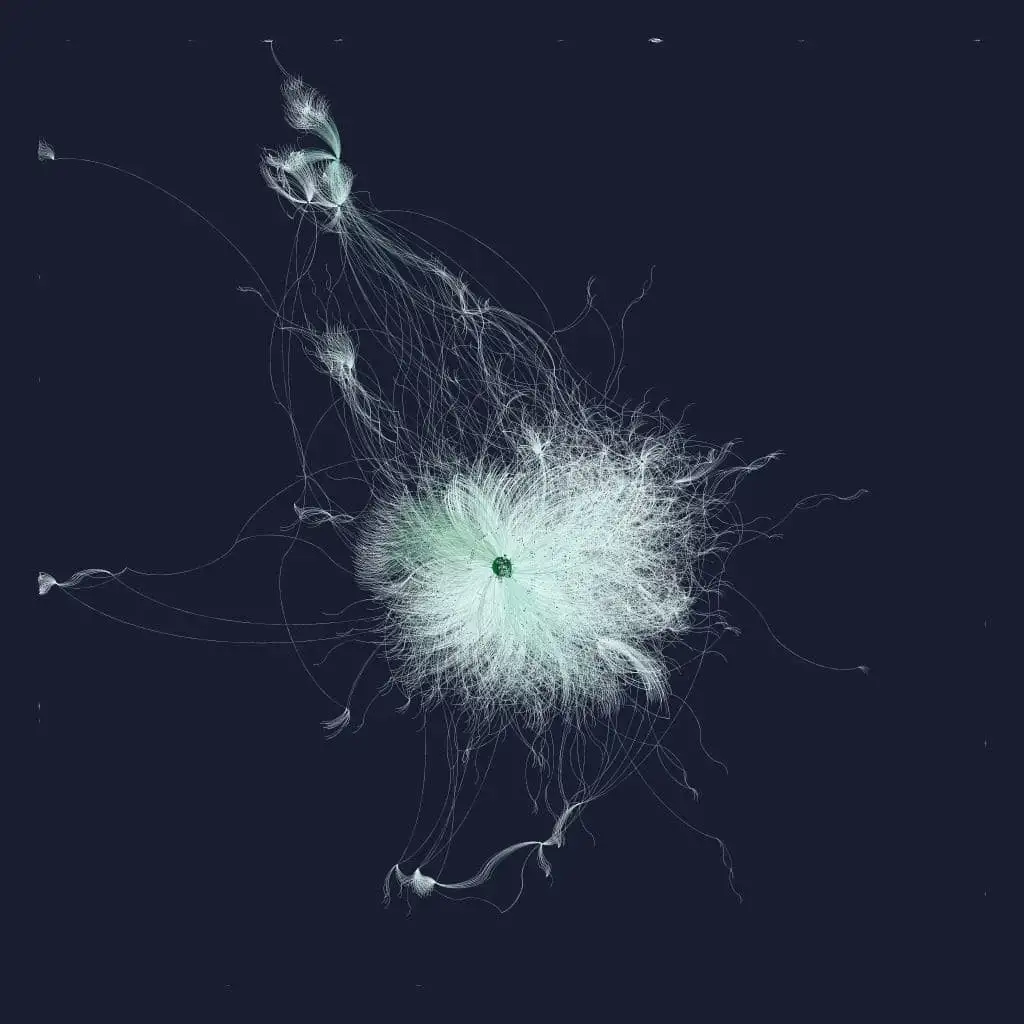

Ideally, the people who trust you to enter the system are already in your communities, exchanging with one another what they need and want in their lives, forming what is known as a Web of Trust (WoT). A Web of Trust is a technical name for a network used to represent social relations of trust, where the different currents of credit within the circles system flow (see picture above).

In Circles, you can pay people you do not know through what we call transitive exchange. You can think about transitive exchange as the 6 degrees of separation which connect all human beings on Earth. In Circles, credit ripples from person to person through the Web of Trust, swapping people’s Circles, flowing where there is trust until it reaches the person the promise is meant to. You can read more about transitive exchange here.

Secondly, by trusting people, you are sharing with them the power to issue money. Therefore, trust means the ability to give credit to others. In Circles, you trust those who you are willing to give your stuff to. Trusting somebody else’s Circles means that you are willing to accept their IOUs (I Owe Yous) in exchange for something you have to give. People therefore pay by promise.

The more people trust each other’s Circles as a reliable means of payment, claiming the stuff they need to live, the more Circles will be positioned socially as money. In other words, trust in the Circles system means both the ability to issue promises and that you believe other people are real, trustworthy peers in your community capable of going in and out of obligations with you and others.

Remember: Trust is Power.

By linking together the different parts of what makes up an economy (care-takers, makers, distributors, markets, service providers, housing, healthcare, education, etc) people build trust in their own people-powered economy by spending their CRCs for the stuff they need to live, while giving what they have the capacity to share.

Through direct democratic organization, the goal of Circles is to create a truly democratic economy that grants people the unconditional right to live: an unconditional income issued by people and for people from the bottom-up. You can read more about how to organise Circles in your area by using our handbook.

Get Organised:

We currently organise a monthly International Assembly in Chinese, English and Spanish on the last Wednesday of every month where people can come to build trust, learn more about how things work and share how their own communities could take up Circles. Parallely, we organise bi-weekly Trust Parties, to onboard people and communities onto the system so they can get started where they are.

You can reach out to join either by emailing us at hello@joincircles.net or by joining our International Assembly Chat on Telegram.

(1): Don’t get us wrong. We have nothing against cash in it of itself. It’s a safe and anonymous credit system. We are well aware of the war on cash, waged by private fintech companies like VISA looking to monopolize the infrastructure of payments away from bills and coins and into their servers. These companies don’t give people power to issue their own promises, they just simply privatize the promises of the state and charge a fee for it. We aim at building digital forms of cash that are secured and trusted. Whether that is related to the State or not is a matter of political praxis.

YOU MIGHT ALSO LIKE

“Circular weaving experiment” by beadtailor

“Circular weaving experiment” by beadtailor

Dsrrptv + Dscntrlzd ≠ Dscnnctd: A Review on Disruptive Technologies and Data Protection